Auto Loan Calculator

Main Features

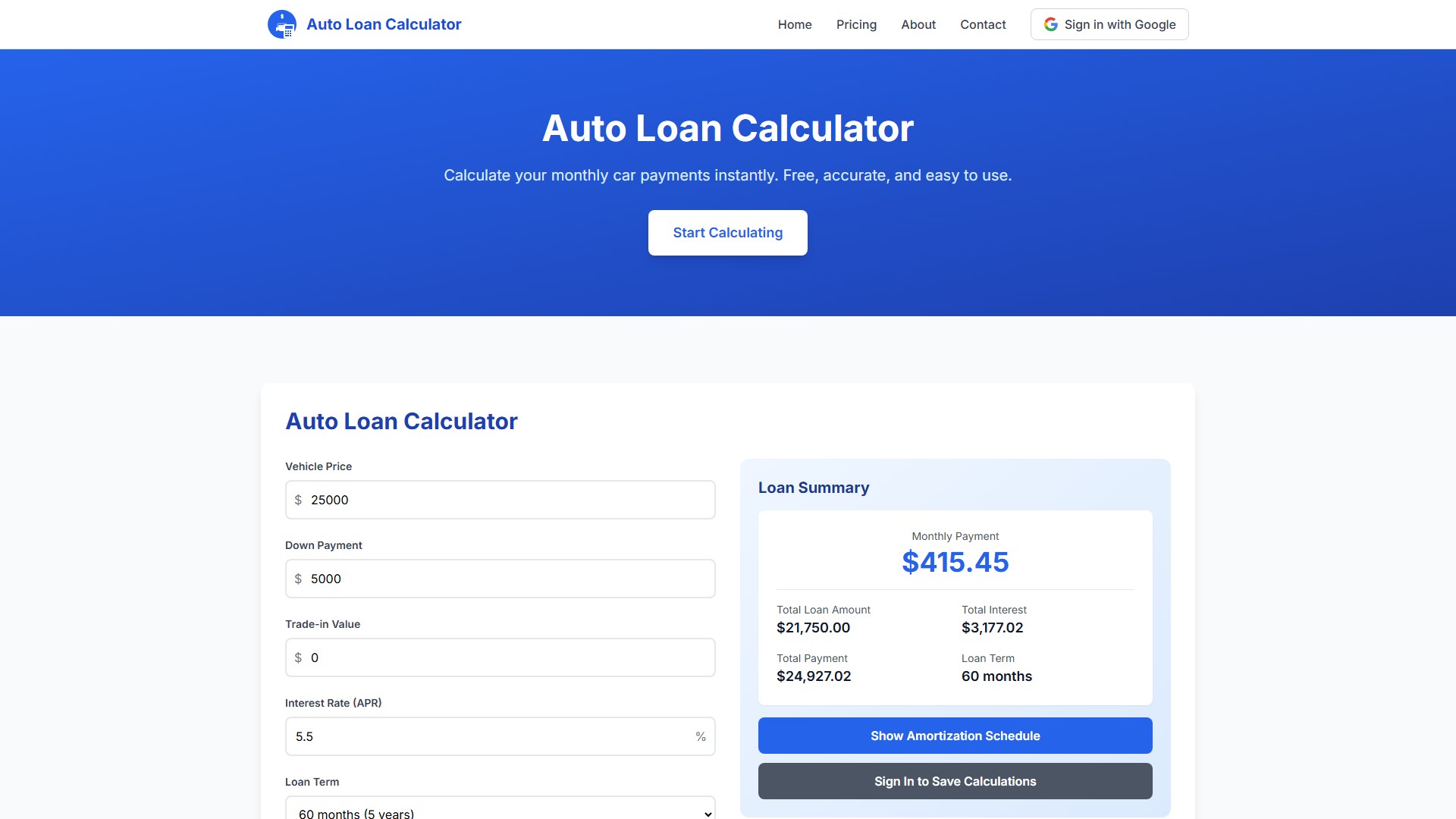

- Calculate monthly payment, total loan amount, total interest, and total payment

- Provide complete amortization schedule

- Support input of vehicle price, down payment, trade-in value, interest rate, loan term, and sales tax rate

- Display multiple loan term options (12-84 months)

How to Use

- Enter vehicle price (use MSRP for new cars or asking price for used vehicles)

- Input down payment amount (ideally 20% for new cars or 10% for used ones)

- Add interest rate offered or estimate using current 2025 market rates

- Select preferred loan term (typically between 36 and 72 months for optimal balance)

- Include sales tax, documentation fees ($500-$1,500), and trade-in details for complete monthly payment estimate

Core Advantages

- Instant Results: Get accurate monthly payment calculations in seconds

- Comprehensive Analysis: See total interest, monthly payments, and complete amortization schedules at a glance

- Save Money: Compare different loan scenarios to find the best deal and save thousands on interest

- Free to Use: No waiting, no sign-ups required

Pricing Model

- Free Version: Basic loan calculation features

- Premium Version: Save unlimited calculations, export PDFs, access analytics, ad-free experience

Target Users

- Potential car buyers

- Consumers needing loan scenario comparisons

- Financial planners

- Car dealers and sales personnel

Typical Use Cases

- Budget planning before car purchase

- Comparing costs of different loan terms

- Evaluating interest rate impact based on different credit scores

- Analyzing down payment impact on monthly payments

Frequently Asked Questions

- How accurate is this calculator? Uses standard amortization formulas to provide highly accurate estimates. Actual payments may vary slightly based on lender-specific fees and terms.

- What is APR? APR (Annual Percentage Rate) is the yearly interest rate charged on your loan. It includes the interest rate plus any additional fees or costs associated with the loan.

- Should I make a larger down payment? A larger down payment reduces your loan amount, resulting in lower monthly payments and less interest paid over the life of the loan.

- What loan term should I choose? Shorter loan terms mean higher monthly payments but less total interest paid. Longer terms have lower monthly payments but cost more in total interest.

가격 모델:

Freemium

Paid

의론